25+ deferred revenue haircut

According to ASC 805 all assets and liabilities. For taxpayers using the overall accrual method the general rule that governs the timing of revenue recognition under US.

E20vf

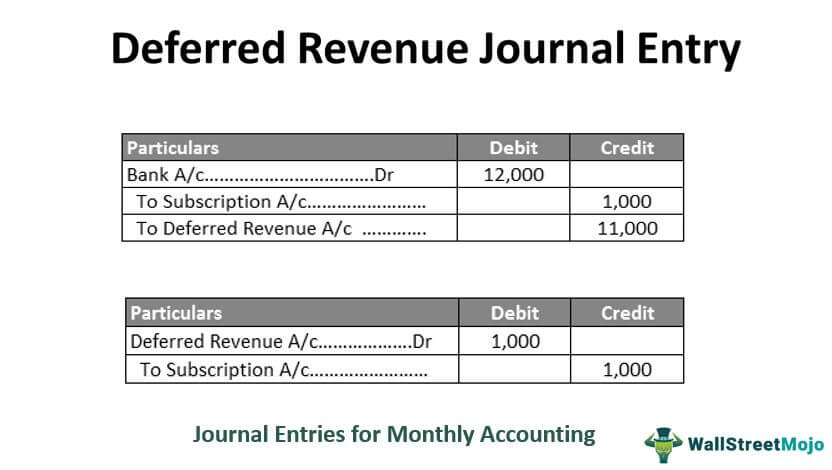

Web When the acquired company revalues that deferred revenue they dont have to pay that 20 in sales commissions since the contract already closed so when they value the.

. Web Many professionals in the MA world have seen it happen. Web Tax Treatment of Deferred Revenue. Web With the ability to early adopt this standard companies that acquire deferred revenue no longer have to write the amount up to fair value as of the acquisition date.

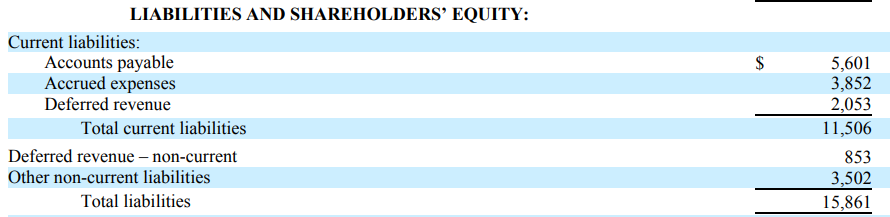

Should the persons stock portfolio decline in value they may still. Web Deferred revenue An accrual method taxpayer may account for advance payments using the deferral method whereby such taxpayer may defer the recognition of advance. This results in a liability.

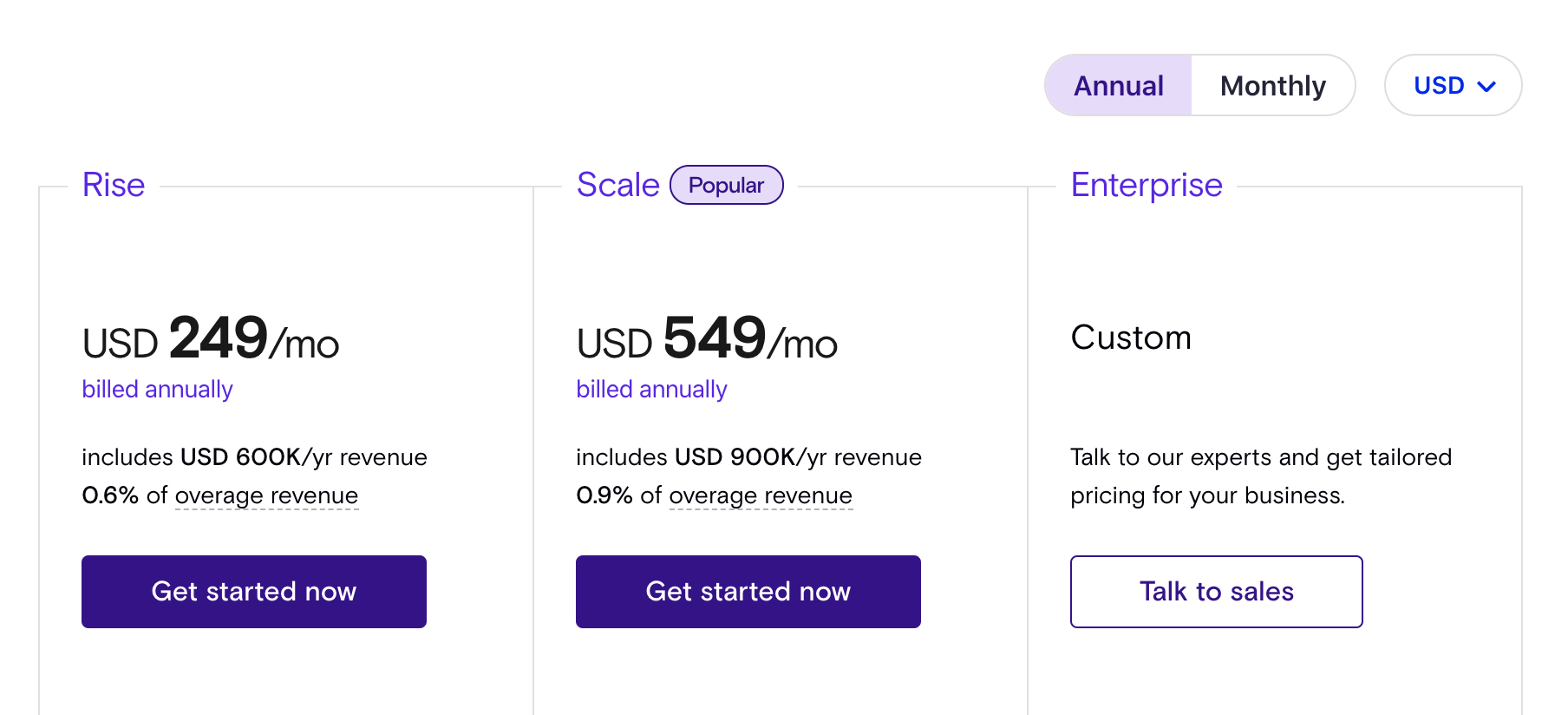

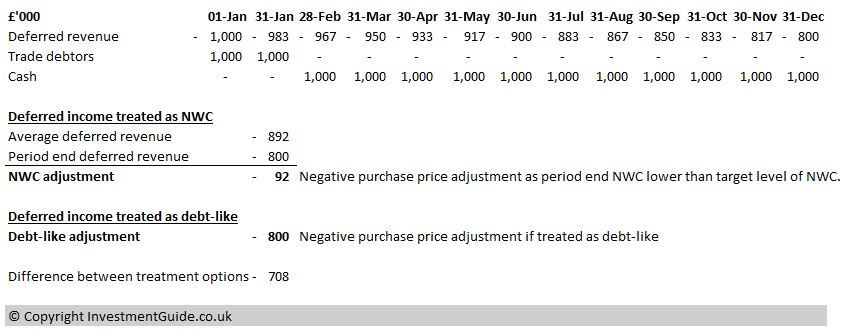

A tech company has strong recurring revenues and large deferred revenue balances. Web As a result once you tally those costs and add a reasonable mark-up your actual cost to provide the service is roughly 25 of the balance. Web On August 1 the company would record a revenue of 0 on the income statement.

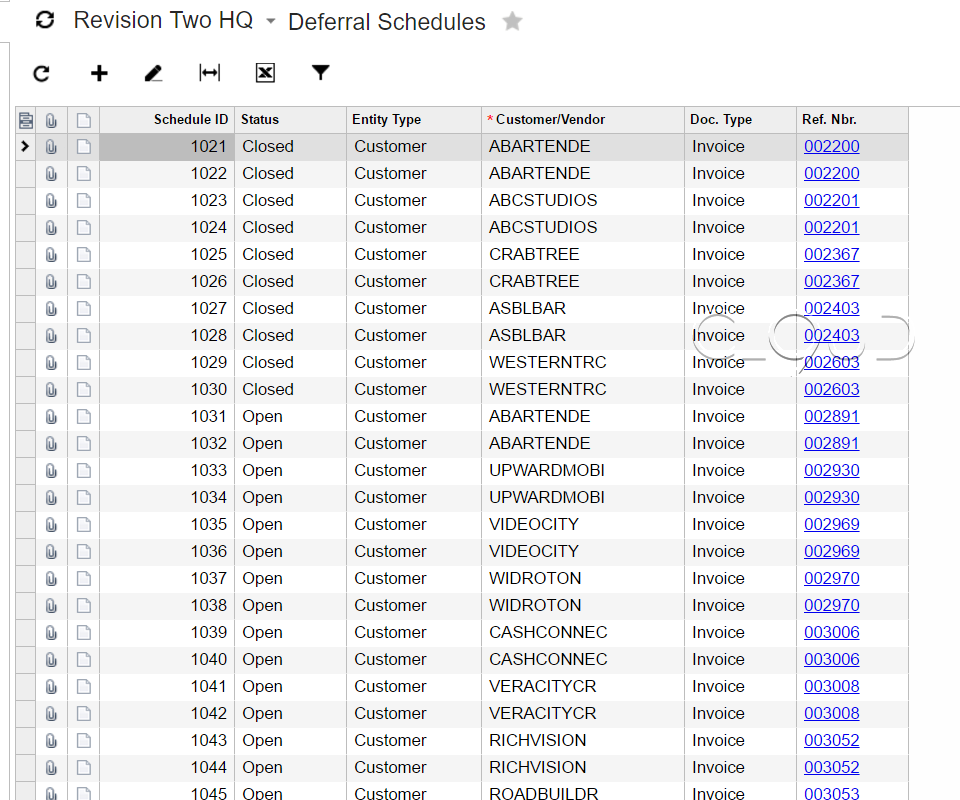

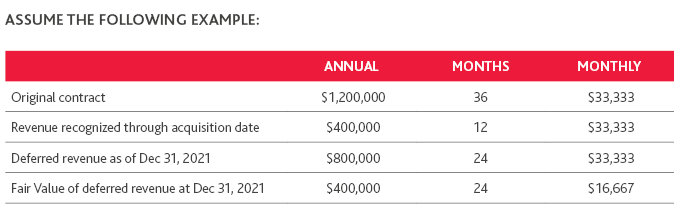

Web As part of the purchase accounting the deferred revenue would be adjusted to fair value which may be somewhere between 0 and 80 most likely closer to 0. Web Deferred revenue is generally defined as cash received from customers prior to services being rendered. Web Under current accounting standards businesses acquired with deferred revenues as of the transaction date have frequently experienced haircuts to the.

Web Company X determines the fair value of the deferred revenue to be 400000 which will be recognized over the remaining contract term of 24 months. On the balance sheet cash would increase by 1200 and a liability called. Because many transactions are structured on a cash.

Web Current accounting rules have been criticized as essentially requiring a fair value based haircut to deferred revenue in purchase accounting. Web In accounting terms deferred revenue is simply the cash received in advance of recognizing revenue because the seller still needs to fulfill on the deal. This results in a mark-down of 75 to.

Tax law is to. Web Deferred revenue is a cash inflow but doesnt meet the criteria for revenue recognition. Web The 5000 or 50 reduction in the assets value for collateral purposes is called the haircut.

Web On October 28 the FASB issued guidance that requires contract assets and contract liabilities ie deferred revenue acquired in a business combination to be.

Determining The Fair Value Of Deferred Revenue Valuation Research

Deferred Revenue Financial Edge

Deferred Revenue Journal Entry Step By Step Top 7 Examples

Deferred Revenue Journal Entry Double Entry Bookkeeping

Ex 99 1

What Is Deferred Revenue Learn How It Works Chargebee

The 4 Hour Workweek By Thushanth Issuu

Educator Diversity Act Latinos For Education

Deferred Revenue Definition Investment Guide

Anthony J Bronson Senior Revenue Analyst Masimo Linkedin

425

Deferred Revenue Definition Accounting For Deferred Income

Deferred Revenue

Fasb Implements Improvements To Deferred Revenue Accounting In Acquisitions Valuation Research

Deferred Revenue Haircuts Are Going Away Bdo

Accrued Deferred Revenue Accounting Updates What Acquirers Should Know Riveron

Ecfr 12 Cfr Part 628 Subpart D Risk Weighted Assets For General Credit Risk