35+ Income to mortgage ratio calculator

Monthly gross income is calculated by 70000 divided by 12 which equals 5833. Relative to your income before taxes your debt is at a manageable level.

15 Debt Payoff Planner Apps Tools Get Out Of Debt Debt To Income Ratio Managing Finances Money Saving Strategies

Total monthly debt payments divided by total monthly gross income before taxes and other deductions.

. You most likely have money left over for saving or spending after youve paid your bills. While DTI ratios are widely used as technical tools by lenders they can also be used to evaluate personal financial health. The front-end debt ratio is also known as the mortgage-to-income ratio and is computed by dividing total monthly housing costs by monthly gross income.

Apply for a mortgage or home equity loan with Hudson Valley Credit Union. For example lets say that the lender requires a 2836 ratio with a yearly gross income of 70000. The amount of money you spend upfront to purchase a home.

Ad Need Help Calculating Your Mortgage Payment. Debt-To-Income Ratio Calculator Use our free mortgage calculators to quickly estimate what your. Lenders often require a maximum debt-to-income ratio between 36 and 43 to approve you for a mortgage to buy a house.

Then multiply that number by 100. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Ad Our Calculators And Resources Can Help You Make The Right Decision.

The maximum debt-to-income ratio with one compensating factor is 37 front. In addition to your mortgage-to-income ratio its also important to research different. Estimate The Home Price You Can Afford Using Income And Other Information.

Ad Top Home Loans. Use our income-debt ratio calculator also called a debt-income ratio calculator to learn how much of your income goes toward monthly debts. In the United States normally a DTI of 13 33 or less is considered.

Your DTI is good. Ad Calculate mortgage rates - adjustable or fixed how much you might qualify for more. 35 Income to mortgage ratio calculator Sabtu 03 September 2022 Edit.

A 20 down payment is ideal to lower your monthly payment avoid. And the Debt-to-income ratio mortgage calculator will be of great use to those who need to compute this quickly. Its Never Been A More Affordable Time To Open A Mortgage.

Relative to your income before taxes your debt is at a manageable level. For backend DTI you have a 35 percent ratio if your total. The maximum debt to income ratio with zero compensating factors is 31 front-end and 43 back-end DTI.

Find A Great Lender Today. With the 35 45 model your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income or 45 more than your after-tax income. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

35 or less. When you apply for credit your lender may calculate your debt-to-income DTI ratio based on verified. Debt-To-Income Ratio Calculator Use our free mortgage calculators to quickly estimate what your new home will cost 10-Year Fixed Rate Interest Rate 2550 Interest Rate.

Most home loans require a down payment of at least 3. The debt-to-income formula is simple. Try Our Free Tool Today.

Some lenders may accept a debt-to-income ratio of 45 or higher. Looking Good Relative to your income your debt is at a manageable level.

Mortgage Calculator Monthly Payments Screen Mortgage Loan Calculator Mortgage Payment Calculator Mortgage Amortization Calculator

Simple Loan Calculator Using Javascript Css

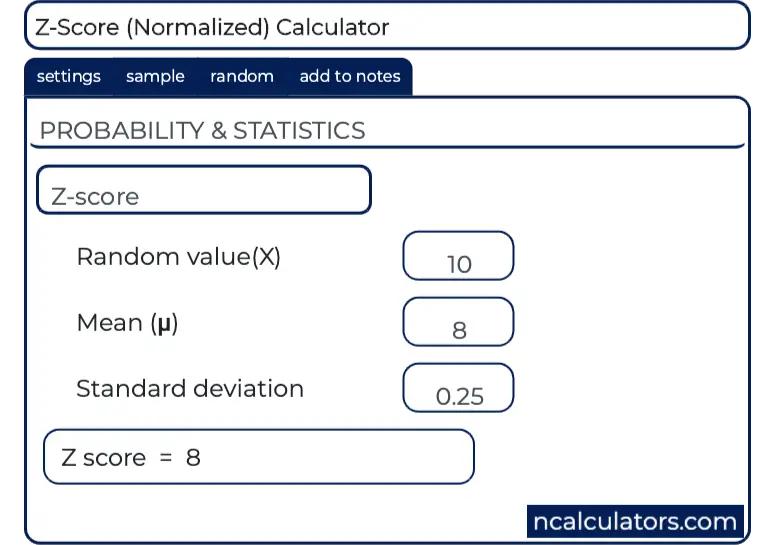

Z Score Calculator

Back End Debt To Income Ratio Debt To Income Ratio Debt Ratio Debt

Using Pv Function In Excel To Calculate Present Value

Is This An Affordable Mortgage For Me Household Expenses Debt To Income Ratio Debt

Tuesday Tip How To Calculate Your Debt To Income Ratio

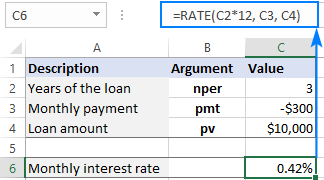

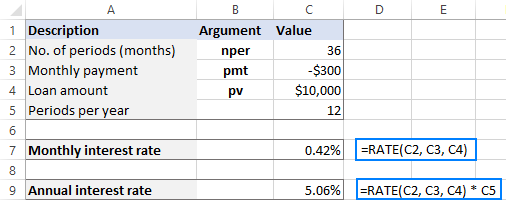

Using Rate Function In Excel To Calculate Interest Rate

Using Rate Function In Excel To Calculate Interest Rate

Ipmt Function In Excel Calculate Interest Payment On A Loan

Fha Debt To Income Calculator Debt To Income Ratio Real Estate Advice Fha Loans

On An Income And Expense Statement Is The Money I Received From A Loan Considered An Income Or An Expense Quora

Ipmt Function In Excel Calculate Interest Payment On A Loan

How Much Do You Have To Make To Afford A 10 Million Dollar House Quora

Interest Rates Mississauga Real Estate Mls

Budget Calculator Budget Planner Mls Mortgage Budget Calculator Budgeting Amortization Schedule

As A Canadian Minimum Wager I Pay 3 Out Of 15 I Earn Per Hour Into Taxes How Much Of This Will I Get Back In The Future In Some Form Rrsp Quora